Read Accounting for small companies is done by keeping a total record of all the income and expenses and accurately extracting financial details from company deals. This is a needed task that assists small company owners track and manage their cash successfully– especially during the early stages. It also ensures that the records will be in place for filing a federal tax return.

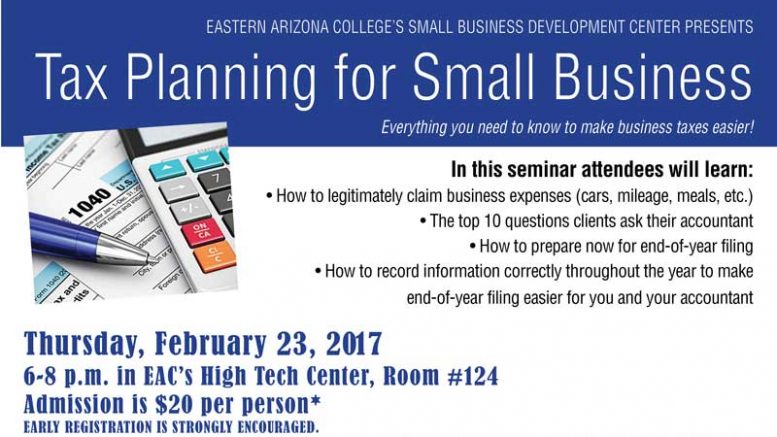

What this post covers: Tax planning for small business owners. The procedure of accounting begins with evaluating financial deals and getting in the ones relating to the service entity into the accounting system. For instance,loans considered individual reasons are not included in the business documents The initial step of the accounting process includes the preparation of source files.

The balances of the debit and credit columns need to be equal. If not,the trial balance includes mistakes which need to be situated and remedied with remedying entries. It is very important to keep in mind that some errors may exist despite the debits equating to credits,such as errors caused by double posting or due to the omission of entries.

For example,earnings earned but not recorded in the books. Adjusting entries are made for accrual of earnings and expenses,devaluation,allowances,deferrals and prepayments. When the changing entries are made,an adjusted trial balance must be prepared. This is done to evaluate if the debits match the credits after the changing entries are made.

The monetary declarations which consist of the earnings statement,statement of changes in equity,balance sheet,declaration of capital and notes are completion items of the accounting system. To prepare the system for the next accounting,short-term accounts that are procedure periodically,including the income,expense and withdrawal accounts,are closed.

The last step of the accounting cycle is to prepare a post-closing trial balance to check the equality of the debits and credit amounts after the closing entries are made. This trial balance consists of real accounts just as the short-term accounts are closed this accounting cycle. When you begin a business,open a separate checking account that will keep your company financial resources different from your personal ones.

There are essentially two approaches of recording earnings and costs– the money basis and the accrual basis of accounting. Under the cash-basis approach of accounting,you record income and expenses when cash deals are done. For example,you tape earnings for an item just when the customer pays you for the product.

Under this method,you record earnings when you make a sale and expenditures when you incur them. This is regardless of whether you received or paid cash for the services or product. You must use a double-entry accounting system and record two entries for every transaction. As a small company owner,you have the choice of working with a CPA tax accountant,taping deals by hand or utilizing an accounting software to tape your service transactions.